Table of Content

If you purchased your home late in the year, you do not even have a full year of home ownership deductions. In fact, 2023 could see the rise of a new type of tax credit for buying a house. Let’s break down the tax credit for buying a house in 2023 and explore what it means for first-time home buyers specifically.

The First-Time Homebuyer Tax Credit is the First-Time Homebuyer Act of 2021 and it offers a $15,000 tax credit to first-time home buyers that meet specific requirements. For instance, are you aware of the First-Time Homebuyer Act of 2021? While it’s still awaiting passage in Congress, if passed, the bill will provide a federal tax credit of up to $15,000 to first-time homebuyers. The federal government offers homeownership tax breaks to all qualifying homeowners, including first-time buyers. VA loans — The U.S. Department of Veterans Affairs backs mortgages from private lenders.

What Is the First-Time Homebuyer Credit? Does It Still Exist?

The $15,000 First-Time Home Buyer Tax Credit has precedent which makes it the most likely first-time buyer program to pass Congress. The bill for first-time buyers is modeled on the $8,000 First-Time Home Buyer Tax Credit from the 2008 Housing and Economic Recovery Act. The First-Time Homebuyer Act of 2021 aims to help low- and middle-income Americans attain homeownership. Insurance related services offered through Credit Karma Insurance Services, LLC, which does business in some states as Karma Insurance Services, LLC. Christina Taylor is senior manager of tax operations for Credit Karma. She has more than a dozen years of experience in tax, accounting and business operations.

Under IRS law, your mortgage insurance premium counts as mortgage interest that you can deduct on Schedule A of Form 40. Amortgage credit certificate is a tax credit given by the IRS to low and moderate income homebuyers. Generally the program is only available to first time homebuyers. An MCC can be a great way to use your home to save money on your taxes, but there are some drawbacks as well as hidden costs, so use caution in deciding whether to use the program.

Are there alternatives to the first-time homebuyer credit?

The credit lets new homeowners convert up to $2,000 of the mortgage interest they paid in a given year into a nonrefundable tax credit. If you paid more than $2,000 in mortgage interest in your tax year, whatever remains can still be itemized and deducted from your taxable income – but you’ll have to be sure to reduce your deduction by the amount you were credited. Unfortunately, the 2017 Tax Cuts and Jobs Act limited deductible property taxes.

We expect the bill to pass into law in some form before the end of the year. Homebuyer publishes a special newsletter on the topic. Keep reading to learn more about the first-time homebuyer tax credit, along with tax credits that you can take advantage of today. The HomePath Ready Buyer program, also through Fannie Mae, allows a 3% down payment on mortgage loans for first-time homebuyers.

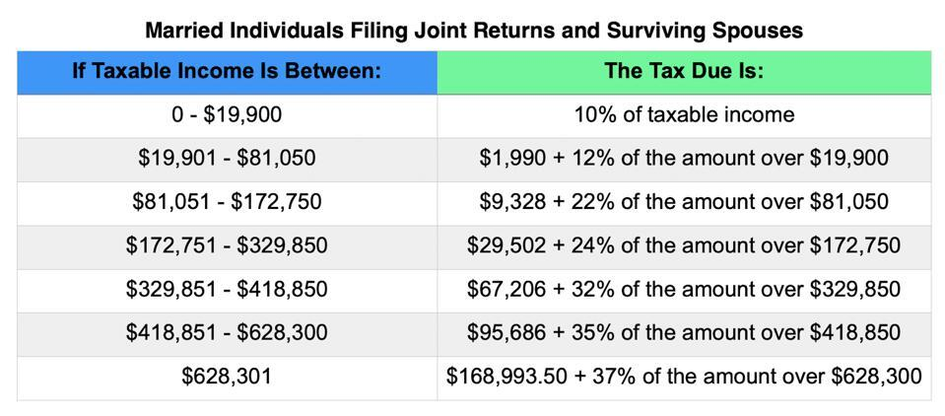

How do I know if my income is too high for the First-Time Homebuyer Act?

This form will enumerate “how much you paid in mortgage interest and points during the tax year.” Your lender will also send this form to the IRS. As such, you should make sure that the amount listed on your tax return is the same as that which your lender reports. Your closing costs on your new home are not deductible except for prepaid interest, prepaid property tax or loan origination fees. There are no deductions for appraisal, inspections, title searches, settlement fees.

Payroll Payroll services and support to keep you compliant. Small Business Small business tax prep File yourself or with a small business certified tax professional. File with a tax pro At an office, at home, or both, we’ll do the work. DC Tax Abatement Program Updates Visit our DC Tax Abatement program guide for the most up-to-date information. The Office of Tax and Revenue updated two key components of the DC Tax Abatement Program and... All users of our online services are subject to our Privacy Statement and agree to be bound by the Terms of Service.

Bank products and services are offered by Pathward, N.A. See Online and Mobile Banking Agreement for details. Federal pricing will vary based upon individual taxpayer circumstances and is finalized at the time of filing. If you need help handling an estate, we're here to help.

According to Bergal, many states and counties across the U.S. “have approved tax credits for residents who make their homes more accessible.” Today, states are motivated to provide homeowners with these accessibility tax credits. This is because “it’s much more expensive for Medicaid…to pay for nursing home care” than to help people stay in their homes. In a nutshell, this refundable tax credit may be applied to your tax return at the end of the year and is equal to 10% of a home’s purchase price. For instance, if your home is worth $200,000, you will still only receive $15,000 in tax credits, not $20,000 (which would be 10% of a $200,000 home price). The first type of tax credit is known as the "tax credit for first-time homebuyers." This credit is available to anyone who has never owned a home before.

In recent months, Democratic members of Congress have argued for removal of the pass-through deduction. In her October 2021 article “As Tax Changes Brew In Congress, Outlook Is Grim For Pass-Through Owners” for Forbes, Lynn Mucenski Keck explains. According to Keck, a tax proposal recently issued by the House Ways and Means Committee would limit this deduction if passed. So far, the bill has not passed and the pass-through deduction remains unchanged.

Finally, first-time homebuyer loan programs, of which there are many, generally enable people with low or moderate incomes or with less-than-stellar credit scores to live a part of the American Dream, which is to say, purchase a home. Check this overview of the many targeted loan programs available for first-time homebuyers. U.S. Representative Earl Blumenauer (D-OR) and other lawmakers introduced legislation in April 2021, to support first-time homebuyers with a refundable tax credit of up to $15,000.

However, for many people, the biggest barrier to homeownership is the upfront cost. In recent years, the federal government has introduced tax credits to help first-time homebuyers overcome this barrier. Property taxes are also a great avenue when it comes to deductions. You get to write off your annual property taxes the year you pay them. As for mortgage insurance, you can receive an insurance premium if you paid a down payment less than 20% of the home’s original value.

But you can begin your search process with some online research. One of the best places to search for such incentives is through local and state government websites. That adds up to $36,000 per year, and therefore it would make more sense to skip the standard deduction and claim the mortgage interest deduction. This is the number one advantage of homeownership. "This national government program would give a tax credit for 10% of your home’s purchase price, up to $15,000, to eligible taxpayers," said Bennett.

Offer first-time home buyer programs to help make buying a house more affordable. While they may not offer tax benefits, these programs usually provide grants, loans, and/or financial assistance for closing costs or down payments. But programs will vary by state, so be sure to look into your state or local government’s details for any important terms and restrictions.

Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions. When you use an ATM, in addition to the fee charged by the bank, you may be charged an additional fee by the ATM operator. See your Cardholder Agreement for details on all ATM fees. For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents.

No comments:

Post a Comment